Lincoln Financial Mobile

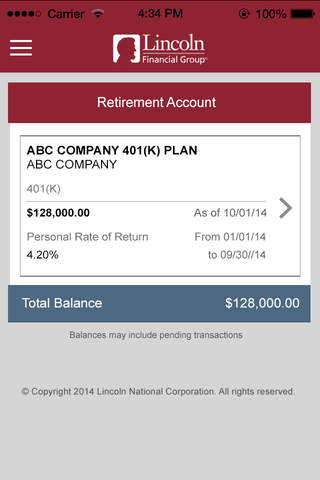

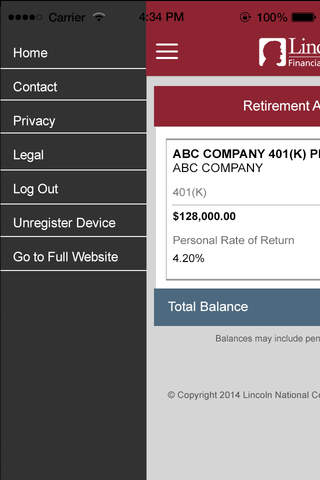

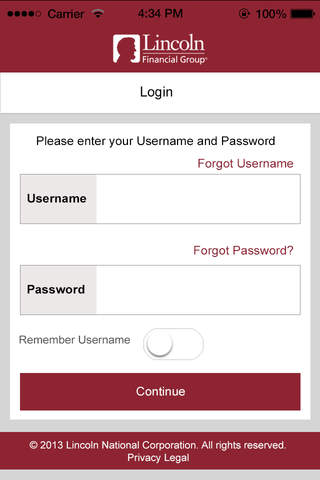

Accessing your Lincoln account information is easier than ever with our new, redesigned mobile app, Lincoln Financial Mobile. You can also download the Apple Watch app for quick access to account information.

We’ve completely refreshed the mobile experience. Ongoing investments in cybersecurity help keep your information secure while offering a simple login experience. Get easy access to retirement account balances, retirement income estimates and explore helpful financial education resources, including videos and calculators. Visit www.LincolnFinancial.com for additional information.

Key Features:

Lincoln WellnessPATH ®

Our proprietary financial wellness solution provides tools and personalized steps to manage your financial life. From creating a budget to building an emergency fund to paying down debt, our easy-to-use online tool helps you turn information into action so you can focus on both short- and long-term goals, such as saving for retirement or providing protection for your loved ones.

My TargetSM calculator

The My Target calculator allows you to easily see how your account balance may translate into monthly income after retirement. With Click2ContributeSM integration, it’s simple to increase contributions to help meet your savings goals.

Click2Contribute1

The Click2Contribute feature makes it easy to increase your contribution rate by selecting one of three preset percentages. To better prepare for a change, the contribution planner also shows how an increase may impact your paycheck.

Contributions tab1

The Contributions tab allows you to update deferral amounts and easily see a detailed breakdown of your year-to-date contributions. If you make Roth contributions, you’ll also see a lifetime cost basis versus earning breakdown.

Investments tab

The Investments tab provides an interactive graph of your account balance over time.

My next steps

My next steps helps you prioritize actions on the road to retirement like consolidating your assets or increasing your knowledge.

This feature may not be available for all plans.